In today's business landscape, the ability to make strategic acquisitions is more critical than ever. For organizations looking to expand their reach and enhance their capabilities, integrating acquisitions into the core of business strategy is essential. However, achieving success in a decentralized organization presents unique challenges. Local decision-making must be empowered by clear information streams, robust education, and a compensation structure that aligns incentives across various levels of the company. When these elements work in harmony, they can effectively support a thriving acquisition strategy.

Understanding financial metrics such as return on equity and EBITDA is vital for evaluating potential acquisitions, particularly in private companies where transparency can vary. Return on equity serves as a measure of a company’s profitability and efficiency in using shareholders' equity, while EBITDA multiples can be a double-edged sword in valuation practices. By recognizing the advantages and pitfalls of these metrics, organizations can navigate the complexities of acquisition valuations and foster informed decision-making that aligns with their overarching goals. In this article, we will delve deeper into these interconnected themes, exploring how to harmonize decentralized decisions to master acquisitions, enhance financial understanding, and achieve sustainable growth.

Strategic Importance of Acquisitions

Making acquisitions a core component of an organization is essential for driving growth and enhancing competitive advantage. In today's fast-paced business environment, companies often face external pressures to expand their market reach, diversify their product offerings, or innovate their services. By integrating other businesses, organizations can quickly acquire new technologies, talent, and customer bases that would otherwise take years to develop organically. This strategic move not only accelerates growth but also enables firms to respond effectively to changing market dynamics.

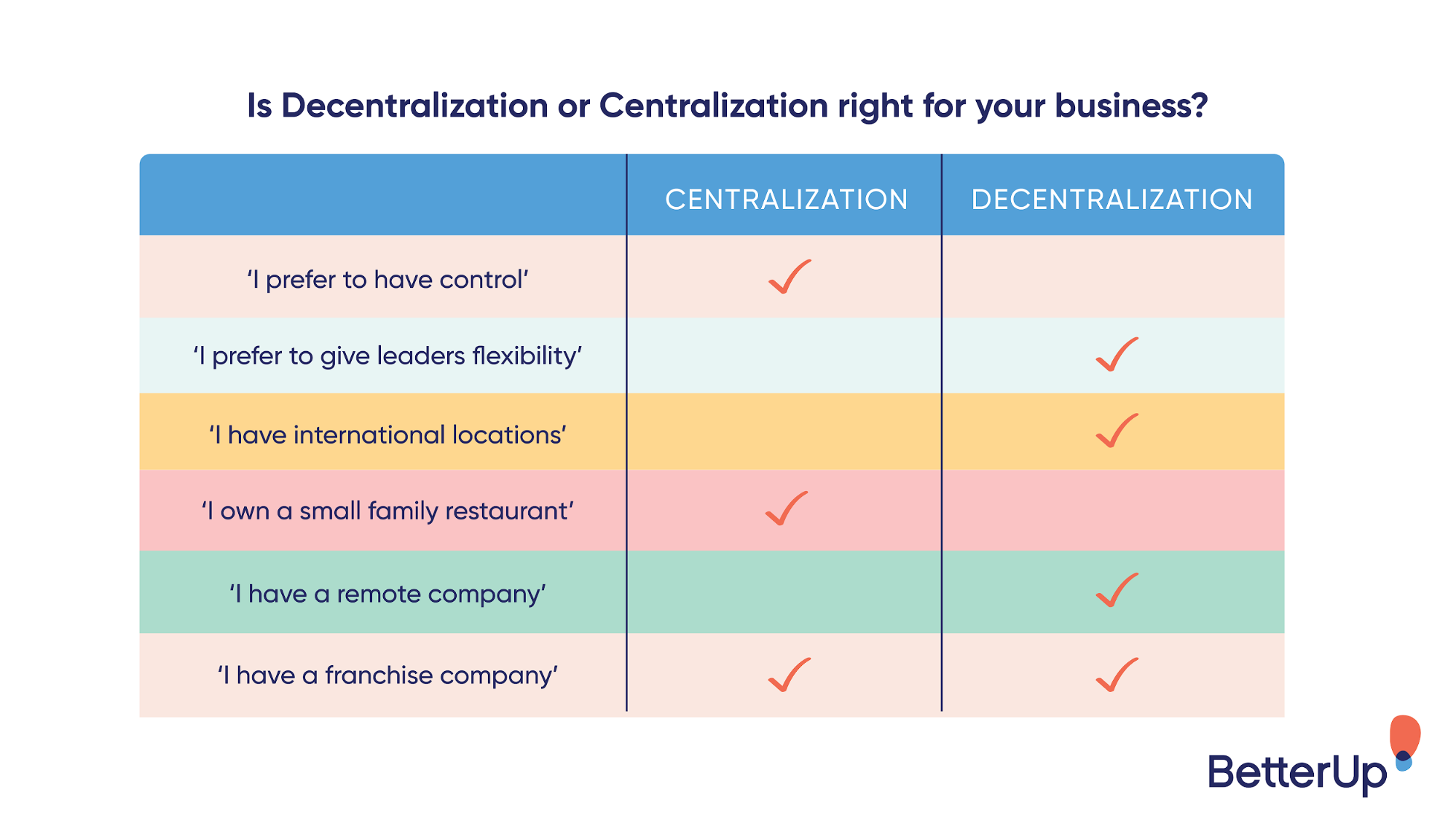

In a decentralized organization, the approach to acquisitions requires careful management of local decision-making processes. Empowering local teams to make acquisition-related decisions fosters a sense of ownership and accountability. However, this autonomy must be paired with robust systems for information sharing and education. By providing local managers with the right data and insights, along with appropriate incentives linked to organizational goals, companies can ensure that acquisitions align with both local and overarching strategic objectives, promoting a harmonious integration across all levels.

Understanding return on equity in the context of private companies is crucial when evaluating the success of acquisitions. ROE serves as a key indicator of how effectively a company utilizes its equity to generate profits. For private firms, where financial information may not be as readily available, gaining a clear understanding of ROE implications can inform better acquisition strategies. By focusing on sustainable growth and long-term value creation, organizations can leverage acquisitions not only to boost their financial performance but also to strengthen their market positioning over time.

Decentralized Decision-Making Framework

In a decentralized organization, the effectiveness of local decision-making hinges on the alignment of information, education, and compensation across various levels. This framework promotes a culture where local leaders are empowered to make decisions that reflect the unique needs of their markets while staying true to the overarching strategic goals of the organization. By equipping teams with the necessary information and resources, organizations can foster an environment that encourages informed choices and accountability at every level.

Education plays a critical role in this framework, as it ensures that local decision-makers understand the broader context of their choices. Training programs focused on company values, market dynamics, and financial literacy can bridge the knowledge gap between different levels of the organization. Such initiatives cultivate a sense of ownership among employees, allowing them to confidently navigate decision-making processes that impact their specific areas.

Compensation structures also need to align with the decentralized decision-making model, reinforcing desired behaviors and outcomes. By linking rewards to both individual performance and the overall success of the organization, companies can incentivize local leaders to prioritize long-term growth over short-term gains. This harmonious relationship between decision-making, education, and compensation ultimately drives the organization towards sustainable success, particularly in the context of acquisitions and value creation.

Linking Local Decisions with Corporate Goals

In a decentralized organization, it is crucial to ensure that local decision-making aligns with the overarching corporate goals. This alignment requires a clear framework that empowers local managers to make informed choices while understanding how their decisions contribute to the broader strategic vision. Training and education play significant roles in this process. By equipping local teams with the necessary knowledge about corporate objectives, they can make decisions that not only serve immediate needs but also propel the organization forward.

Communication is another vital element in linking local decisions with corporate goals. Regular interactions between local managers and corporate leadership foster an environment where feedback and insights can flow in both directions. This exchange of information allows local teams to stay attuned to corporate priorities and contextualize their decisions within them. Additionally, establishing key performance indicators that reflect both local and corporate objectives ensures that everyone is working towards a unified goal.

Compensation structures should also reflect the importance of aligning local actions with corporate aspirations. Implementing incentive systems that reward local managers who contribute effectively to corporate goals reinforces the behavior needed for overall success. When local decision-makers see a direct correlation between their efforts and potential rewards, they are more likely to make decisions that benefit the organization as a whole. This approach not only enhances motivation but also fosters a culture of shared responsibility and accountability throughout the organization.

Understanding Return on Equity in Private Firms

Return on Equity, or ROE, is a crucial financial metric for private firms, as it measures how effectively a company uses its equity to generate profits. In a private company context, understanding ROE can be more challenging due to the lack of public financial disclosures. However, it remains an essential tool for owners and managers to evaluate the company's financial health and investment attractiveness. A higher ROE indicates that a firm is efficiently using shareholders' funds to produce earnings, which is particularly important for attracting potential investors or for planning future acquisitions.

The calculation of ROE is straightforward: it is computed by dividing net income by shareholder equity. However, the interpretation of this ratio can vary significantly in private firms, where factors such as retention of earnings, capital structure, and industry standards play a critical role. For owners of private companies, achieving a satisfactory ROE is essential not only for operational success but also for enhancing the value of the company over time. This understanding can drive strategic decisions, including reinvesting profits or considering reasonable dividend payouts to balance growth and shareholder satisfaction.

Furthermore, the significance of ROE extends beyond just financial performance; it also has implications for management practices within a decentralized organization. By linking local decision-making with equity performance, managers can cultivate a culture of accountability and performance orientation. Education and communication around ROE can empower local leaders to make decisions that positively impact the bottom line, aligning their actions with the overall goals of the organization and promoting a harmonious approach to company growth.

Evaluating Acquisition Valuations

When assessing acquisition valuations, EBITDA multiples often serve as a popular tool among investors and analysts. This valuation method focuses on a company's earnings before interest, taxes, depreciation, and amortization, providing insight into a firm's operational profitability. However, reliance solely on EBITDA can present challenges, especially when comparing companies across various industries or business models. Discrepancies in capital structure, tax rates, and investment needs can distort the apparent attractiveness of a valuation based on EBITDA alone.

In addition to the limitations of using EBITDA multiples, it's crucial to consider the broader context in which a company operates. Factors like market conditions, growth potential, and competitive landscape play a significant role in shaping a company’s true value. Engaging in thorough due diligence helps to identify potential synergies, risks, and growth opportunities associated with the acquisition. This comprehensive evaluation ensures a more accurate reflection of the company's worth, allowing decision-makers to align their motivations with tangible business goals.

Moreover, understanding the distinct differences between public and private companies further complicates the acquisition valuation process. Private firms often lack readily available financial metrics compared to their public counterparts, resulting in increased reliance on estimates and projections when determining EBITDA multiples. This uncertainty can lead to discrepancies in valuation, and thus professionals must use a variety of methods and approaches to triangulate a reasonable acquisition price. Balancing multiple valuation methods not only helps mitigate risk but also provides a clearer picture of the target’s intrinsic value, supporting more informed decision-making.

EBITDA Multiples: Benefits and Drawbacks

EBITDA multiples are a popular method for valuing companies during acquisitions, offering a straightforward way to compare firms within the same industry. One of the primary benefits of using EBITDA multiples is their ability to provide a clear snapshot of a company's operational performance, stripping away non-operational factors such as financing and tax structures. This focus allows acquirers to gauge how effectively a company generates earnings from its core operations, making it easier to identify potential targets in the market.

However, relying solely on EBITDA multiples can lead to significant drawbacks. One major flaw is that EBITDA does not account for capital expenditures or changes in working capital, which can be crucial for understanding a company's true financial health. This omission can result in overvaluing a business that may require substantial investments to maintain or grow its operations. Additionally, market conditions and accounting practices can distort EBITDA figures, making it essential for buyers to look beyond these multiples and consider a more comprehensive valuation approach.

In conclusion, while EBITDA multiples can be a valuable tool in the acquisition process, they should not be used in isolation. A balanced methodology that incorporates other valuation metrics and a thorough understanding of the target company's operational nuances will yield a more accurate and effective assessment. Integrating these insights into the acquisition strategy can lead to more informed decisions and ultimately enhance the overall success of the organization.

Creating Harmonious Integration Strategies

To successfully harmonize decentralized decision-making with a focus on acquisitions, organizations must establish integration strategies that bridge local autonomy with centralized guidance. Providing local managers with the authority to make decisions fosters a sense of ownership and accountability. However, this autonomy should be complemented by robust informational frameworks and regular training programs, enabling managers to align their strategies with the overall organizational goals. Educating local leaders on the critical aspects of acquisitions, including the impact on Return on Equity and effective valuation methods, is essential for informed decision-making across all levels.

Compensation structures should be designed to incentivize local managers to pursue acquisition opportunities that not only meet their immediate objectives but also align with the company's long-term vision. By linking performance metrics to broader organizational goals, businesses can create a cohesive environment where local decision-making enhances overall performance. This approach ensures that all levels of management are engaged in the integration of acquisitions, fostering collaboration between local and central teams. It is crucial for the top management to clearly communicate the strategic importance of acquisitions as a core pillar of the organization.

Finally, evaluating the effectiveness of these integration strategies requires ongoing assessment and refinement. Organizations must remain agile, adapting their approaches based on market dynamics and internal feedback. Regularly reviewing the outcomes of acquisitions, including their influence on Return on Equity and the efficacy of EBITDA multiples as valuation measures, allows companies to gauge success and recalibrate their strategies. This continual alignment between local decision-making and centralized oversight will ensure that the organization not only masters acquisitions but also achieves sustainable growth through a decentralized yet unified approach.